Quality that compounds: DWPF outperforming across all time horizons

- Brad Collier, Fund Manager, Dexus Wholesale Property Fund

- 16 December 2025

Market cycles test conviction. They separate short-term thinking from long-term discipline. At DWPF, we’ve always believed that quality assets, managed with skill and foresight, outperform over time. The past year has reinforced that belief.

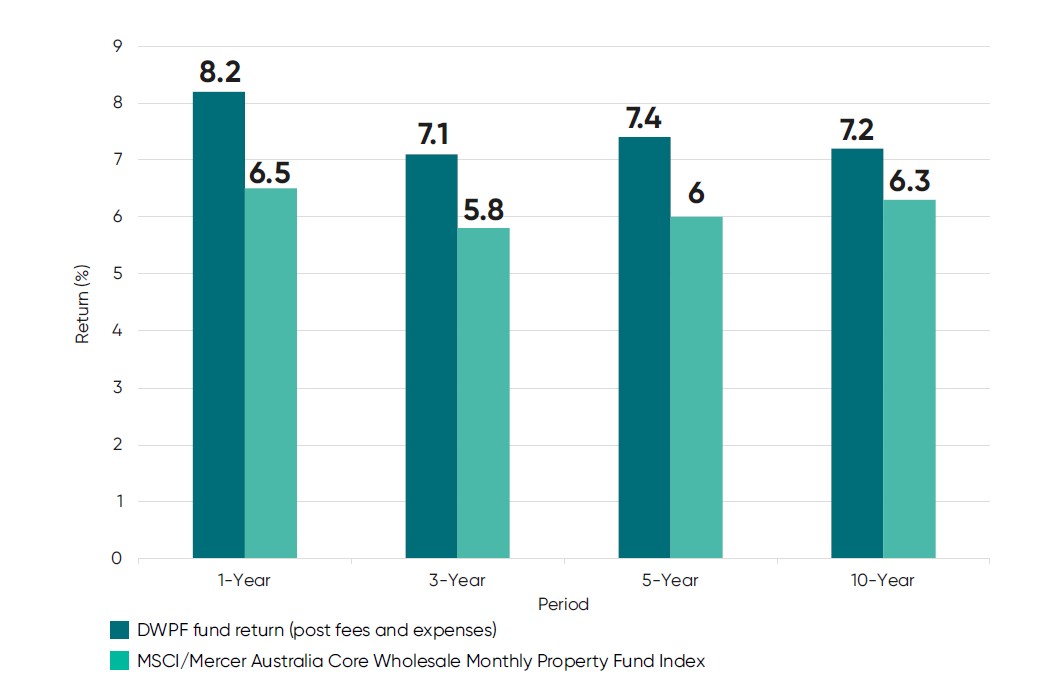

DWPF has outperformed its benchmark across every reported time horizon from one to 10 years, and across all sectors in its diversified portfolio1. Performance over the past 12 months has been particularly strong with DWPF delivering an 8.2% fund return2 for the 12 months to September 2025 – the strongest annual performance in more than three years for our investors.

One of the most notable aspects of the result is that DWPF’s portfolio outperformed in all three sectors – office, retail and industrial – demonstrating the portfolio’s quality is not concentrated in a particular sector or limited to a handful of assets.

Comparative performance

DWPF has consistently outperformed the MSCI/Mercer Australia Core Wholesale Monthly Property Fund Index (post fees, net asset weighted) across all reported time horizons1.

A portfolio built to endure

DWPF’s advantage is the product of 30 years of disciplined portfolio construction, deep market relationships and a commitment to quality that is difficult to replicate. Today, that foundation supports a circa $13 billion portfolio positioned for both stability and performance. And what's particularly compelling is DWPF's diversified structure provides the ability to capture the upside from tailwinds in all sectors.

The office portfolio is widely regarded as one of the best in the market. Landmark assets such as Gateway and Quay Quarter Tower in Sydney, and the $2.5 billion Waterfront Brisbane development - already more than 50% pre-committed - are benefiting from the flight to quality, and flight to core trends. Gateway recently achieved one of the highest net rents in Australia and it’s this leasing success that has driven a total return of over 13% for the last 12 months.

In retail, well located prime centres such as Indooroopilly and Westfield North Lakes continue to benefit from growth in the Queensland economy. And in industrial, the completion of Ravenhall in Melbourne’s west will deliver further development upside while improving the quality of the portfolio.

A number of retail assets have embedded potential future development opportunities that could further diversify the portfolio while capturing the Australia’s demographic tailwinds.

Market confidence returns

With valuations past the bottom of the cycle, investor sentiment continues to rebound. Secondary market activity is increasing and there are less opportunities to buy in at a discount.

We’re also seeing active engagement from offshore investors, led by major Asian investors who are entering Australia for the first time and supported by European investors seeking exposure to Australian real estate. This activity reflects a broader trend: mandates are being revisited and quality is the focus.

Importantly, some investors who had previously signalled withdrawals, are reassessing their positions and choosing to maintain exposure. While individual decisions vary, the pattern seems clear - capital is flowing toward scale, diversification and proven performance, and momentum is building at the right moment in the cycle.

Positioned for what’s next

The commercial real estate landscape has shifted. The winners will be those with scale, quality assets, operational depth and the financial strength to act decisively. DWPF has these attributes, demonstrated by a track record of delivering through cycles.

The 8.2% return for the year is more than a milestone – it signals that quality is being rewarded and the market is turning. For investors, DWPF’s multi-cycle performance and diversification provide confidence that the Fund is positioned to continue delivering for investors.

1 Over 1, 3, 5 and 10 year time periods at 30 September 2025. Past performance is not a reliable indicator of future performance.

2 Post fees and expenses.

Disclaimer

This report is issued by Dexus Wholesale Property Limited (ACN 006 036 442, AFSL No. 238166) (the “Responsible Entity”) in its capacity as responsible entity of Dexus Wholesale Property Fund (the “Fund”). The Fund comprises three stapled head trusts and two registered schemes, Dexus Wholesale Property Trusts 1 & 2 (ARSN 090 499 013) and Dexus Wholesale Property Trust 3 (ARSN 601 440 377). The Responsible Entity is a wholly owned subsidiary of Dexus (ASX: DXS).

This report has been prepared for informational purposes only and is not an offer, solicitation or invitation to invest in units or stapled securities and is not financial product advice. A stapled security in the Fund comprises one unit in each of the above-mentioned stapled trusts.

Information in this report, including, without limitation, any forward-looking statements, or opinions (the “Information”) may be subject to change without notice. To the extent permitted by law, the Responsible Entity and Dexus, and their officers, employees and advisers do not make any representation or warranty, express or implied, as to the currency, accuracy, reliability, or completeness of the Information. Actual results may differ materially from those predicted or implied by any forward-looking statements for a range of reasons outside the control of the relevant parties.

The Information contained in this report contains general information about the Fund and does not purport to be, and should not be considered to be, comprehensive or to comprise all the information which a Fund investor or potential investor may require in order to determine whether to invest in the Fund. This report does not take into account the financial situation, investment objectives and particular needs of any particular person.

The repayment and performance of an investment in the Fund (including any particular rate of return referred to in this report) is not guaranteed by the Responsible Entity, Dexus, any of their related bodies corporate or any of their officers, employees and advisers. Any such investment is subject to investment risk, including possible delays in repayment and loss of income and principal invested. Past performance is not an indication of future performance.

All currency figures are expressed in Australian dollars (AUD) unless otherwise specified. This document may not be distributed to any person in any jurisdiction outside Australia where it would be contrary to applicable laws, regulations or directives.

Due to rounding, any numbers presented throughout this report may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.