The United States has announced a series of tariffs and other countries like China, Canada and Mexico are responding.

Welcome to "Corporate"

You are now viewing the main section of our website.

To switch to Leasing or Investing, use the menu above.

This year marks a turning point for commercial real estate. After years of rising interest rates and shifting consumer behaviours, the outlook is changing for the better.

Falling interest rates and stabilising property values are delivering greater confidence in real assets, although heightened geopolitical risks and economic uncertainty created by the new US administration mean further volatility can be expected in some markets.

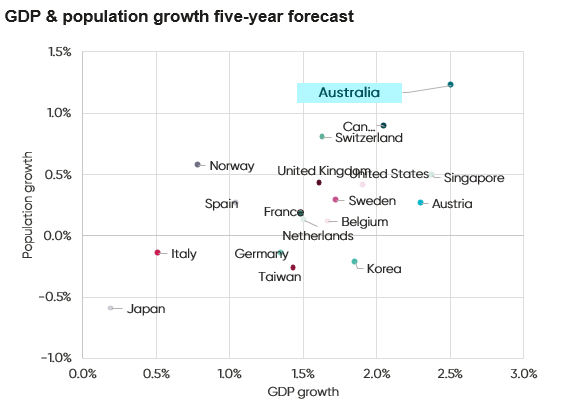

Australia, however, offers a stable political environment along with firming GDP growth and high population growthed. These are excellent buffers against a volatile global environment that should solidify Australia’s reputation as a safe haven among global investors.

Retail is proving more resilient than anyone thought five years ago, workers are returning to the office and alternative sectors like data centres and healthcare continue to pique investor interest. Driven by e-commerce and logistics, industrial remains strong while rising urban density is supporting growth. Opportunities are emerging. Against this

backdrop, understanding the shifting dynamics of real estate investment is more important than ever. Here’s what’s shaping the market in 2025.

Forecasts are for a total of 60 basis point cut in the official cash rate this year. After a period of falling commercial property values, stabilisation is in sight. Despite bond yields remaining relatively high, capitalisation rates are also stabilising and yields are high.

However, uncertainty and volatility has increased due to the unpredictability of the US administration, although those global risk factors, should they eventuate, are likely to apply further downward pressure on rates.

In volatile investing environments, assets with strong rental growth and resilient income streams are likely to become particularly attractive. Industrial and retail real estate, in particular, are experiencing renewed interest with investor demand returning.

While there is uncertainty around the pace and scale of rate cuts, it is clear that lower interest rates support real estate investment. Capitalisation rates are steady and deal flow is improving.

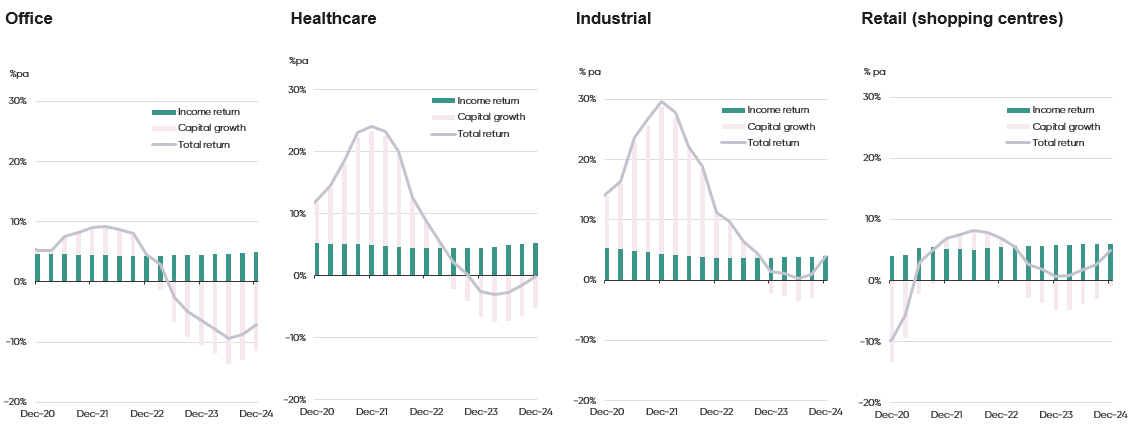

Helped by these factors, , total returns rose in the fourth quarter of 2024, with retail and industrial leading healthcare and office. We expect this trend to continue in 2025.

Past performance is not a reliable indicator of future performance

The United States has announced new tariffs, prompting retaliatory measures from China, Canada, and Mexico. While trade restrictions generally slow global growth and increase market volatility, the long-term impact is uncertain. Australia, however, is well prepared.

Australia’s direct trade with the U.S., Canada, and Mexico is minimal but our economy typically slows when the U.S. suffers a recession. Australian exports are mostly bulk commodities like iron ore, coal, and LNG, which are less exposed to consumer-focused trade policies while tariffs on steel and aluminium are a tiny portion of overall exports.

The primary risk is if China or the U.S. experience a sharp downturn, which would reduce demand for our exports.

The safe haven argument, however, is persuasive. Australia remains attractive to global investors due to its political stability, forecast GDP growth and high population growth. These are powerful buffers against global shocks.

While uncertainty has increased, our view of a broad-based improvement in real estate and infrastructure markets in 2025 remains fundamentally unchanged.

The office market is showing the first real signs of recovery, with demand stabilising, workers returning to the office and tenants re-engaging with decisions around their spaces.

Sublease availability has decreased, and major corporates are taking back space for future expansion. Sydney had the strongest year of take-up since 2016 and Melbourne’s take-up is becoming less negative.

While vacancy rates remain elevated, the market continues to be extremely segmented. Well-located buildings continue to see strong leasing demand, while older or less flexible spaces struggle. A ’flight to quality’, causing tenants to prioritise premium office spaces in core CBD locations, and a ‘flight to value’ continue.

Source: Oxford Economics

The information in this graph is predictive in nature, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties, and results may differ materially from results ultimately achieved and are not guaranteed to occur.

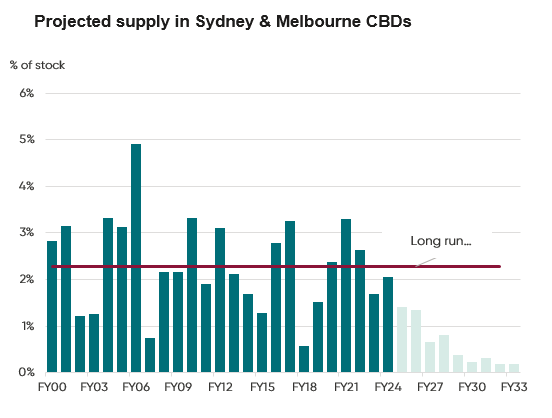

The office market is showing the first real signs of recovery, with demand stabilising, workers returning to the office and tenants re-engaging with decisions around their spaces.

Sublease availability has decreased, and major corporates are taking back space for future expansion. Sydney had the strongest year of take-up since 2016 and Melbourne’s take-up is becoming less negative.

While vacancy rates remain elevated, the market continues to be extremely segmented. Well-located buildings continue to see strong leasing demand, while older or less flexible spaces struggle. A ’flight to quality’, causing tenants to prioritise premium office spaces in core CBD locations, and a ‘flight to value’ continue.

Source: Dexus Research

The information in this graph is predictive in nature, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties, and results may differ materially from results ultimately achieved and are not guaranteed to occur.

The factors needed for a recovery are now in place. Currently, rents are around 20% below that needed to justify new construction and supply will be restricted for the foreseeable future. In Sydney’s CBD, projects planned for completion in the next five years are half of those completed in the past five years. In Melbourne, that figure is a third.

Despite high vacancy rates, growth in employment and constrained supply bode well for the sector. Quality assets in core locations should be a focus for investors’ attention.

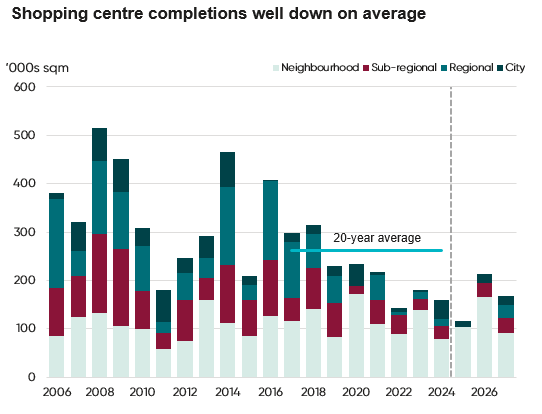

After years of structural challenges, the retail sector is in full bloom. Australia has emerged from a per capita spending drought. Both discretionary and non-discretionary spending are rising, supported by population growth, higher wages, tax cuts and the recent interest rate reduction.

Limited new supply of shopping centres has kept vacancy rates low, while city retail is benefiting from increasing office occupancy and tourism. Investors are once again seeing retail as a viable sector, particularly for well-located assets with strong tenant demand.

Source: ABS, JLL Research, Dexus Research. Shopping centre completions are national.

The information in this graph is predictive in nature, may be affected by inaccurate assumptions or by known or unknown risks and uncertainties, and results may differ materially from results ultimately achieved and are not guaranteed to occur.

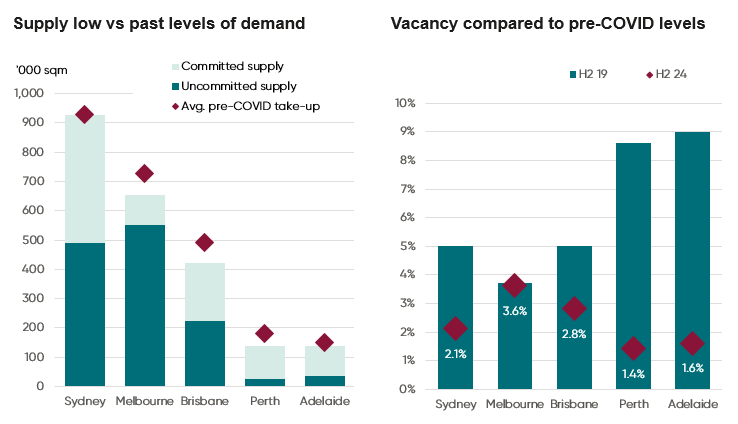

After a period of rapid expansion, the industrial real estate sector is normalising. While demand remains solid, vacancy rates are rising slightly, leading to moderating rental growth in some markets.

Vacancy rates remain low overall but have increased compared to pre-COVID levels. Net effective rent growth is slowing, particularly in outer metro markets, while construction costs have increased, which is impacting development feasibility.

Sydney and Melbourne continue to lead demand, though rent growth is easing, while Brisbane, Perth, and Adelaide are experiencing more moderate leasing activity.

Industrial take-up last year improved from 2023, with further growth expected this year as retail sales strengthen. With uncommitted supply below historical demand levels, there are no major oversupply concerns.

Industrial is a sector no longer experiencing runaway rent growth but strong fundamentals and sustained demand mean it will continue to be a resilient investment class.

Source: CBRE Research, JLL Research, Oxford Economics, Dexus Research

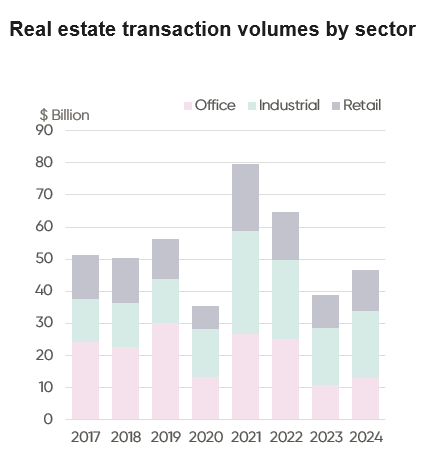

With interest rates easing, transaction activity is expected to strengthen this year. Year-on-year transaction volumes rose 19% in 2024 and, due a large data centre merger and acquisition activity, almost doubled in infrastructure. We expect this activity to strengthen in the year ahead.

Source: CBRE Asia Pacific Investor Preference Survey 2025, MSCI Real Assets (excluding M&A), Infralogic (all transaction types)

2025 is shaping up as a year of transition. Falling interest rates, stabilising values, constrained supply, improving office and retail markets and growing total returns offer good opportunities for commercial real estate investors. While geopolitical risks and economic uncertainty remain, Australia’s strong fundamentals and safe haven status will support the market.

All information contained on this website (“Information”) is subject to change without notice. While every care has been taken in the preparation of the Information, to the extent permitted by law, Dexus (ASX DXS), its related body corporates and each of their respective directors, officers and employees do not make any representation or warranty, express or implied, as to the accuracy, currency, reliability or completeness of any statement in it. including, without limitation, any forecasts, and do not guarantee the repayment of capital, or the performance of or any particular rate of return for any Dexus fund referred to on this website. Past performance is not a reliable indicator of future performance.

The Information has been prepared for the purpose of providing general information only, without taking account of any particular investor’s objectives, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of the Information, and seek professional advice, having regard to their objectives, financial situation and needs.

The Information is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.